A land loan calculator that allows one to enter data for a new or existing land loan to determine one's payment. Enter the purchase price for a home you’re interested in buying, or play around with a range of prices to see how they affect your monthly mortgage payment. " You can estimate how long it will take to pay off the total cost of your loan using our student loan repayment calculator. You can also enter optional extra payments within the table to estimate the interest savings. Step 3: Throw as much money as you … Credible Operations, Inc. Mortgage Balance: $250,000 Interest Rate: 5. The extra payment row with the date paid, the amount paid and 1 for “# periods” Mortgage Recasting Calculator to calculate the new monthly payment if you are planning to recast your mortgage.

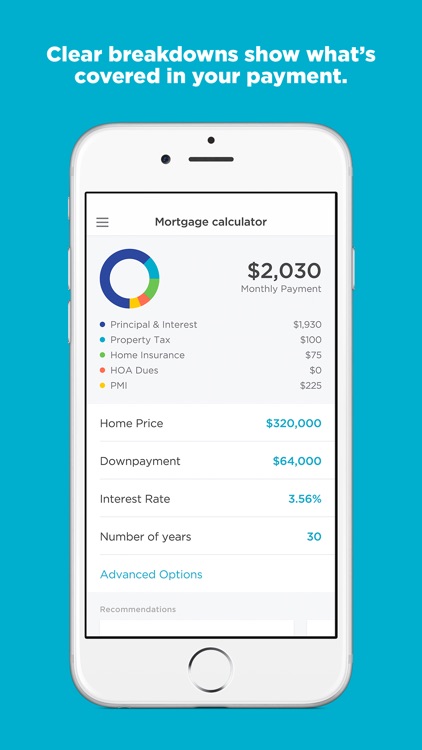

Products are subject to availability on a state-by-state basis. You only need eight pieces of information to calculate your mortgage payment with our mortgage calculator: Home price. Related: This Loan Calculator supports one or more extra payments. Because this is a simple loan payment calculator, we cover amortization This calculator determines the amount of money and time saved from prepayments on a mortgage or loan.

#Nerdwallet mortgage calculator with pmi free

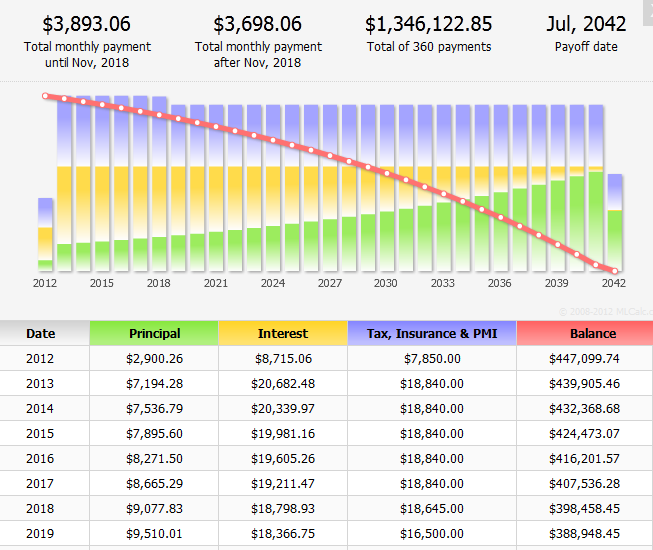

However, if you could pull this off, you would save $360,216! Free Auto Loan, Amortization, Home Equity Loan, and Mortgage Calculators for Microsoft® Excel®. Complete this table with necessary formulas and fill everything down. By the end of the loan, you'll have paid $5,456 in interest. If you make an extra payment of $2,908 every month as well, you'll have your mortgage paid off in 8 years and 11 months, with $253,728 interest savings. You could add 360 extra one-type payments or you could do an extra monthly payment of $50 for 2. 00 per month, the loan will be paid off in 6 years and 2 months. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of … Using our Mortgage Payment Calculator, you can crunch the numbers and discover how much you could save in interest, or how much you would need to pay each month to pay your loan off sooner. Hours worked, food costs, mortgage projections-sometimes you just need to know how much is enough. Keep in mind that you may pay for other costs in your monthly payment, such as homeowners’ insurance, property taxes, and … Your monthly payment on a standard 10-year term would be $212. The mortgage calculator with extra payments gives borrowers two ways to calculate additional principal payments, one-time or recurring extra payments each month, quarter, or year.

Go ahead and play with the table by typing some values in the “Extra payment” column. A balloon mortgage is a mortgage in which a large portion of the borrowed principal is repaid in a single payment at the end of the loan period. Use the … Our simplified loan payment calculator can help you determine what your monthly payment could be including the principal amount and interest charges. It calculates the interest and principal payments for a given loan amount within a set timeframe. To use the calculator, make sure you have the following information available: Vehicle purchase price: This is the amount you financed to purchase your vehicle.

0 kommentar(er)

0 kommentar(er)